7 Things Affect How Long Your Money Will Last in Retirement

Every upcoming retiree wants to know how long their money will last in retirement. To come up with an answer, you need to address all of the seven items in this step by step guide.

The first of the seven items is the rate of return you earn.

The rate of return you earn on savings and investments will have a large effect on how long your money lasts. There have been long periods of time where safe investments (like CDs and government bonds) earned a decent interest rate, and periods of time (like now) where interest rates are quite low.

Same with stocks. There have been decades where stocks provided outstanding returns, and decades where the returns were about the same as what you would get if you had stuck with safe investments. There is no way to know exactly what rate of return you will earn on your money in retirement.

Basing the success of your plan only on average returns is not a good idea. An average means half the time you would have earned something below average.

What to do instead: Check out historical returns by understanding something called rolling returns – this allows you to see both best case and worst case outcomes. You must make sure you plan works if you get an outcome that is below average. You can then run scenarios showing you different options so you know what to adjust in your plan if you earn returns lower than expected.

2 of 7

2. Sequence of Returns

When you are taking money out of accounts, the sequence of returns, or order in which you experience returns, matters. This is referred to as sequence risk. For example, suppose the first five to ten years of your retirement all your investments due well and so you not only have the amount you need to withdraw, but in addition your principal balance grows. In this situation, your chances of running out of money go down.

On the other hand, if your investments do poorly your first few years of retirement, you may need to spend some of your principal to cover your living expenses. It will be harder for your investments to recover at that point.

What to do: Test your plan over numerous possible outcomes. If a poor sequence of returns occurs early in retirement, plan on adjusting your spending and lifestyle down to make sure your money lasts throughout your retirement years.

3 of 7

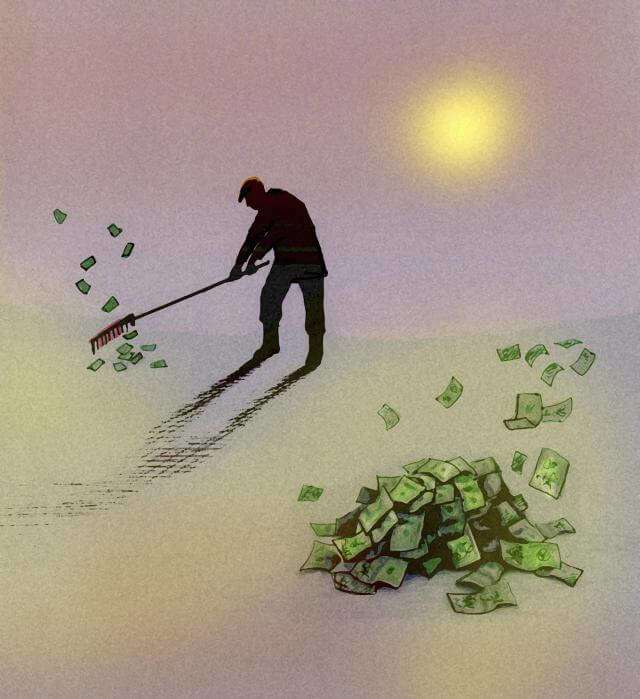

3. How Much You Withdraw

Traditional retirement plans are based on something called a withdrawal rate. For example if you have $100,000 and take out $5,000 a year, your withdrawal rate is 5%. A lot of research has been done on what is called a sustainable withdrawal rate; meaning how much can you withdraw without running out of money over your lifetime. Different studies put that number at anywhere from about 3% to about 6% a year, depending on how your money is invested, what time horizon you want to plan for (30 years verses 40 years for example) and how (or if) you increase your withdrawals for inflation.

What to do: Create a plan that calculates your anticipated withdrawal rate not only year by year, but also as measured over your total retirement time horizon. Depending on when Social Security and pensions start, there may be some years where you need to withdraw more than others. That is OK as long as it works when viewed in context of a multi-year plan.

4 of 7

4. How Much You Spend – And When You Spend It

One of the biggest retirement mistakes I see people make is inaccurately estimating what they will spend in retirement. People forget that every few years they may incur home repair expenses. They forget about the need buy a new car every so often. They also forget to put major healthcare expenses in their budget.

Another mistake people make is spending more when investments do well early on. When you retire if investments perform quite well your first few years of retirement it is easy to assume that means you can spend the excess gains.

It doesn’t necessarily work that way; great returns early on should be stashed away to potentially subsidize poor returns that may occur later. Bottom line: if you withdraw too much too soon it may mean that 10 to 15 years down the road your retirement plan will be in trouble.

What to do: Create a retirement budget and a projection of the anticipated path your accounts and withdrawals will follow. Then monitor your retirement situation in comparison to your projection. If your plan shows that you have a surplus even if poor returns come along – then you can spend more.

5 of 7

5. Inflation

No question about it, stuff costs more now than it did twenty years ago. Inflation is real. However, how much of an effect will it have on how long your money lasts in retirement? It depends. As people reach their later retirement years (age 75 +) their spending tends to slow down in a way that offsets many of the effects of rising prices. In particular, spending on travel, shopping and eating goes down.

It has been shown that inflation will have a minimal affect on higher income households as they spend more money on non-essentials and thus have “extras” that can be given up if inflation rates get high.

Inflation has a bigger affect on lower income households. You have to eat, consume energy and buy basic necessities. When prices rise on these items lower income households don’t have other things in their budget that they can cut out. They have to find a way to cover the necessities.

What to do: Monitor spending needs and withdrawals on a year by year basis and make adjustments as necessary. If you are a lower-income household, consider investing in an energy efficient home, starting a garden and living somewhere with easy access to public transportation.

6 of 7

6. Healthcare Expenses

Healthcare in retirement is not free. Medicare will cover some of your medical expenses – but certainly not all. On average, expect Medicare to cover about 50% of the health-related expenses you will incur in retirement. Lower income retirees can expect to spend almost 30% of their retirement expenses on healthcare related items.

These estimates come from looking at total healthcare related spending which includes premiums for Medicare Part B, Medigap Policies or a Medicare Advantage plan, as well as co-pays and doctor’s visits, lab work, prescriptions, and money for hearing, dental and vision care.

What to do: Take time to estimate your healthcare costs in retirement. It is better to assume they will be high and that you will have to spend your full deductible each year. If you don’t incur the expense then you are free to spend the money on something else. Planning this way leaves you room for extras. It is much better than coming up short.

7 of 7

7. How Long You Live

On average you can expect to live to your mid 80’s. But remember, no one is average. Half the people live longer than average; sometimes much longer. It’s better to build your plan assuming you live longer than average.

If you’re married, you have to account for the potential longevity of whichever one of you should live the longest rather than looking at things as if you were single. If you have an age differential you must think about the life expectancy of the younger of the two of you.

The longer your retirement money needs to last, the more careful you need to be about monitoring it to make sure you are on track.

What to do: Estimate life expectancy and put together a retirement projection, which is a year-by-year timeline of income and expenses. Extend this timeline out to about age 90.